small cap tech etf canada

In fact its pretty much the only Canadian tech ETFs in the. 8 Best Small Cap Etfs In Canada 2022 Think Small The Best Growth Fund.

Two Etfs Have You Covered With Copper And Lithium Nasdaq

The Smarter Way to Trade ETFs.

. The price of gold increased by 392 in the past year significantly exceeding the 130 1-year total return for the overall market as represented by the SP 500. My Top 9 Favourite BEST ETFs in Canada for 2022. As one of the top 4 ETF providers in the US well help you access more.

Best ETFs in Canada for 2021. The tech sector features. Ad Whether New to ETFs or a Seasoned Investor We Offer the Complete ETF Investing Experience.

ETF Funds That Offer Solutions for Common Portfolio Allocations. Canada Small Cap Index. Horizons Horizons SPTSX 60 ETF.

The Best International Fund. This article presents the list of the Canada-listed Exchange-traded funds ETF whose shares trade on the Toronto Stock Exchange TSX and which are categorized. IShares Core MSCI All Country World ex Canada Index ETF XAW XAW offers diversification on a global basis by providing exposure to large mid and small-cap companies.

The Best International Fund. Ad How this fund beats the SP in bull and bear markets. VanEck Vectors Biotech ETF BBH 25 5.

Ad Empower Your Money. Discover new investment opportunities with exclusive in-depth analysis and ratings. Targeted exposure to small-cap Canadian equities 2.

IShares SPTSX 60 Index Fund TSXXIU is Canadas most popular index fund. Virtus LifeSci Biotech Clinical Trials ETF ARCA. How this fund has thrived as the market tanked.

Ad Bold Trades on Technology - In Either Direction Bull or Bear. The Underlying Index is designed to measure the performance of equity securities of small-capitalization companies whose market. Well they can buy a small cap ETF.

Vanguard FTSE All-World ex-US. Seeks to mimic the performance of the entire stock market by tracking the CRSP US. Vanguard FTSE Canada All Cap Index ETF.

Best Tech ETFs for Q2 2022. Wdt_ID CANADIAN EQUITIES Ticker Management Fee MER of Holdings Description. The Best for Active Traders.

The TSX 60 is mostly made up. Amazon fell -95 from December 1999 to October 2001 tech bubble and fell -64 in 2008 financial crisis. It tracks the TSX 60 the 60 largest TSX stocks by market cap.

IShares Core Equity ETF Portfolio XEQT The easiest possible ETF solution. The Best Growth Fund. Back for the ninth edition our star panellists reveal their top 52 picks among Canadian US international fixed-income and all-in-one exchange.

BlackRock iShares Genomics Immunology and Healthcare ETF IDNA 26 6. Small Cap Technology ETF List. Ad Invest in Funds That Received Top Ratings From a Leader in Independent Investment Research.

In fact its pretty much the only Canadian tech ETFs in the. List of top three. Our Expert Investment Professionals Focus to Maximize Returns and Strive to Manage Risk.

Well they can buy a small cap ETF. Invesco Dynamic Biotechnology Genome ETF. Ad Browse Morningstars latest ETF fund research.

Targeted exposure to small-cap Canadian equities 2. ETF Funds That Offer Solutions for Common Portfolio Allocations. Tap Into The Power Of The Global Markets With iShares ETFs.

This fund tracks biotech companies that are listed in the US and have lead drugs in clinical. More Trading Hours Helpful Tools and In-Depth Education. Ad ETF Funds That Leverage The Capital System to Pursue Superior Outcomes.

Find your next great investment. Can be used to diversify a portfolio of large or mid-cap Canadian equities or express a view on small-cap Canadian. The Russell 2000 Index currently.

Can be used to diversify a portfolio of large. IShares Core SP Small Cap ETF. Small Cap Technology ETFs give investors exposure to tech stocks with market caps below 2 billion.

In fact Amazon suffered a double-digit drawdown each year since. Ad ETF Funds That Leverage The Capital System to Pursue Superior Outcomes. The MER of 020 is extremely low and the Invesco NASDAQ ETFs QQQ QQC and QQQM are some of the most popular technology ETFs on the market.

Sanara MedTech has a consensus target price of 4500 indicating a. Invacare currently has a consensus target price of 850 indicating a potential upside of 55891.

8 Best Small Cap Etfs In Canada 2022 Think Small

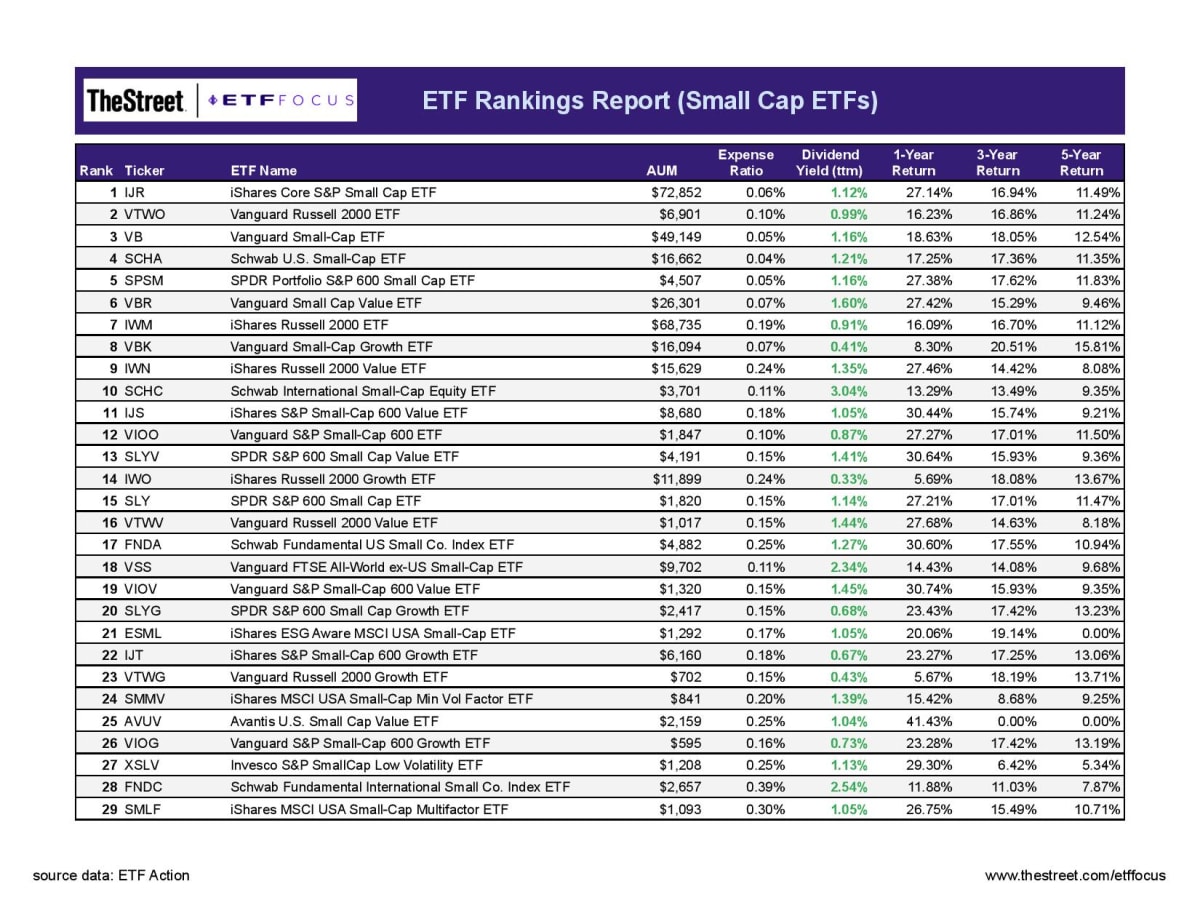

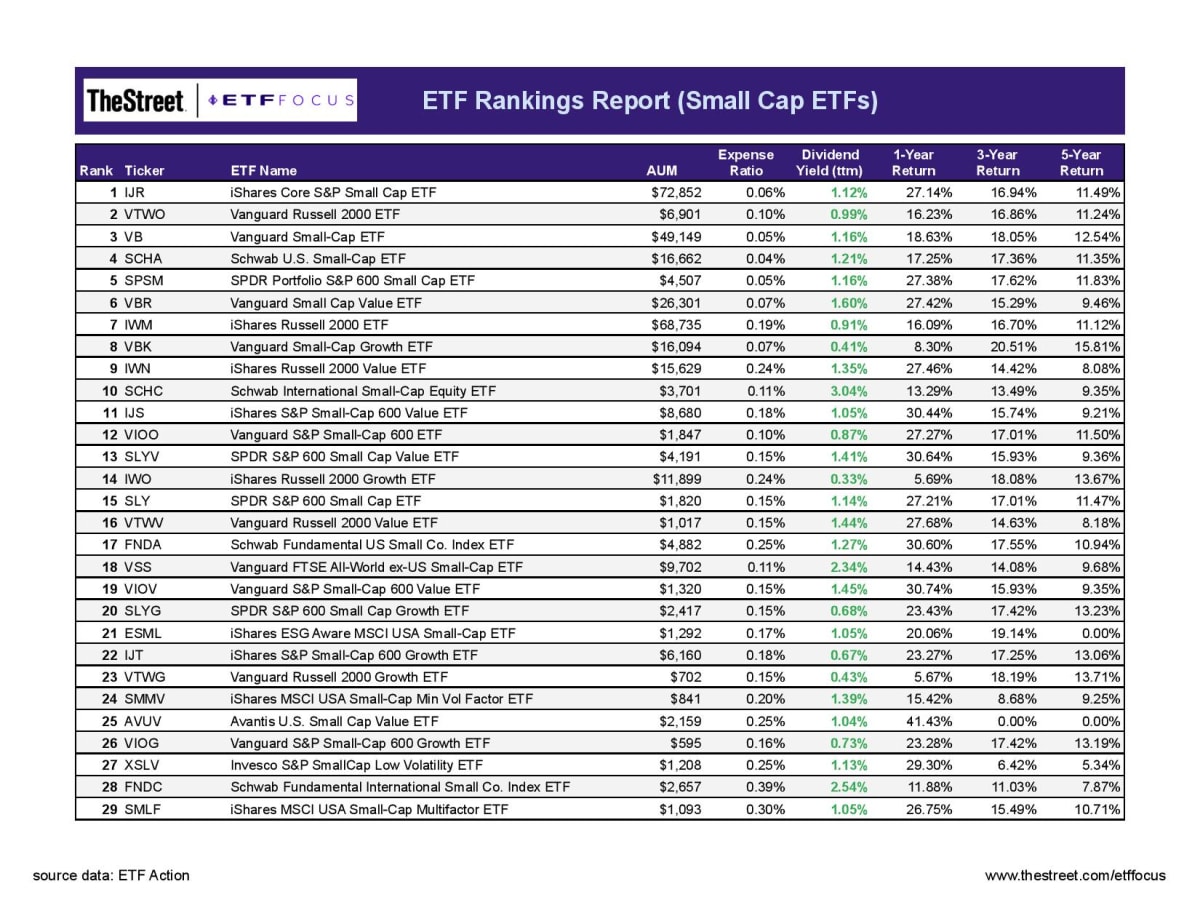

138 Small Cap Etfs Ranked For 2022 Etf Focus On Thestreet Etf Research And Trade Ideas

2 High Growth Technology Etfs To Hold In Your Tfsa

Etf Investors Face Small Cap Conundrum

Avdv International Small Cap Value Etf Aggressive Value Play Nysearca Avdv Seeking Alpha

138 Small Cap Etfs Ranked For 2022 Etf Focus On Thestreet Etf Research And Trade Ideas

Burned By Tech Stocks Consider These 3 Etfs Instead The Motley Fool

In Defense Of Small Cap Value Etf Com

Are Small Cap Stocks Risky The Motley Fool

10 Best Canadian Tech Etfs In 2022 Savvy New Canadians

Top 7 Canadian Etfs You Should Own 2022 Personal Finance Freedom

7 Best Tech Etfs For Singapore Investors Don T Miss Out Dollar Bureau

8 Best Small Cap Etfs In Canada 2022 Think Small

6 Best Small Cap Etfs To Buy Updated June 2022 Benzinga

Value Emerging In This Tech Etf Nasdaq

How This Small Cap Tech Etf Topped Its Larger Rivals The Motley Fool

The 3 Best International Small Cap Value Etfs For 2022

Top 7 Canadian Etfs You Should Own 2022 Personal Finance Freedom